If you’re approaching 65, now is the perfect time to understand the Medicare rules and options so you don’t miss important deadlines. This article walks you through what you need to know as you prepare to enroll.

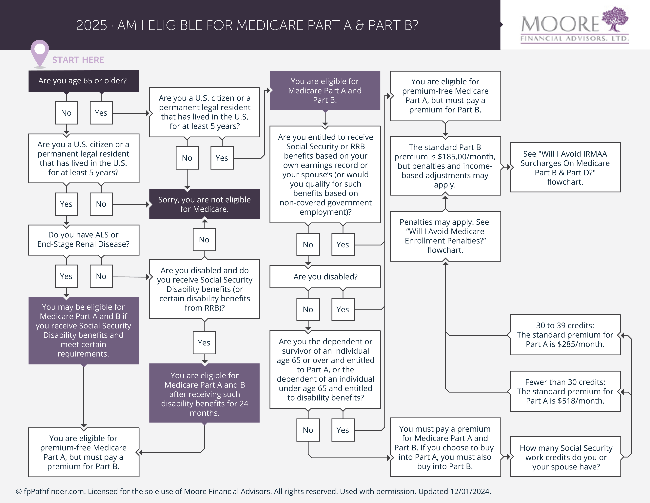

At the end of this article, we provide an “Am I Eligible for Medicare?” flowchart which you can download.

Who Needs to Sign Up for Medicare?

- Most people become eligible for Medicare at age 65.

- If you are retired and not covered by an employer health plan, you’ll need to enroll in both Medicare Part A (hospital coverage) and Part B (medical/outpatient coverage) during your initial enrollment window.

- If you are still working at age 65, you should enroll in premium-free Medicare Part A while you have employer coverage, as it won’t affect your job-based insurance and can offer secondary coverage without a penalty.

- If you are 65, working, and covered by your (or your spouse’s) large employer health plan (20+ employees), you can delay Part B without penalty until you leave that employer coverage. You’ll have a Special Enrollment Period (SEP) for Part B that lasts until 8 months after your or your spouse’s employment or employer coverage ends.

- If your employer is smaller (fewer than 20 employees), Medicare generally becomes your primary insurance at 65, and you’ll need to sign up for both Medicare A and B to avoid gaps in coverage.

When Should You Sign Up?

- Your initial enrollment period is a 7-month window around your 65th birthday: the three months before your 65th birthday, the month of your birthday, and the three months after.

- Signing up before your birthday month ensures coverage starts as soon as you’re eligible.

- If you delay and don’t have other qualifying coverage, you may face late enrollment penalties that last for life.

What Will Medicare Cost in 2026?

- Part A (Hospital Insurance): Generally premium-free if you or your spouse worked 10+ years.

- Part B (Medical Insurance): The standard premium is projected to be $206.50/month in 2026 (up 11% from the 2025 premium of $185/month.)

- Higher-income households may pay more due to IRMAA surcharges. With rising healthcare costs, it’s wise to budget for increases over time.

Original Medicare vs. Medicare Advantage

Medicare Parts A (hospital) & B (outpatient) generally cover about 80% of health care charges in these two categories of care. Most people buy additional insurance to cover the remaining costs of care.

You will need to make a choice between two ways to get benefits to supplement Medicare A & B when you sign up. Below are more details on the two categories of Medicare.

Original Medicare

Original Medicare with a Medigap (supplement) policy offers the widest choice of doctors and hospitals since you can see any provider nationwide who accepts Medicare.

It works especially well if you travel frequently, are a “snowbird”, or want the flexibility to see specialists without referrals.

Pairing Original Medicare with a Medigap policy can help cover deductibles, coinsurance, and copays, giving more predictable out-of-pocket costs.

Most people also need to buy a separate Part D prescription plan, and total monthly premiums (Medicare + Medigap + Part D) can be higher than Medicare Advantage.

Medicare Advantage

Medicare Advantage plans, offered by private insurers, often bundle hospital, medical, and prescription coverage into one plan.

Many include extras like dental, vision, or gym memberships, and premiums can be lower than Original Medicare with a supplement.

However, Advantage plans typically use provider networks (HMO or PPO), which may limit your choice of doctors and hospitals.

Out-of-pocket costs can be less predictable because of deductibles, copays, and coinsurance, especially if you need specialized or out-of-network care.

There’s no one “best” option—it depends on your health, budget, and provider preferences.

Where to Get Help

- www.medicare.gov – The official Medicare website with enrollment and plan comparison tools. You can compare costs and coverage in your area for Medigap and for Medicare Advantage plans. If you set up your account and enter the drugs that you take, you can also compare the total cost of Part D insurers available to you.

- SHIP (State Health Insurance Assistance Program): Free counseling in every state.

- Generally, these services are available by calling your local senior center.

- In Massachusetts, this is called SHINE (Serving the Health Insurance Needs of Everyone).

- Your financial planner – We can help you evaluate Medicare choices in the context of your retirement income, taxes, and long-term health planning.

If you’re approaching age 65, don’t wait. Understanding when and how to enroll in Medicare—and what it will cost—can help you avoid penalties and find coverage that fits your needs.

The flowchart below is a guide that helps you determine if you’re eligible for Medicare Part A & Part B. Click on the image to download or print the chart.

-SM