In this article, MFA founder Susan Moore demystifies the headlines and hype around Social Security, and answers questions that are on the minds of many people who are approaching, or already in, retirement.

With Social Security often in the headlines, many of you have asked: Will it still be there when I retire? Will my benefits be cut?

These are valid concerns—and we’d like to share where things currently stand, what’s being discussed in Washington, and how it could impact your planning.

When Will the Social Security Trust Fund Run Out?

According to the 2025 Trustees Report, the Social Security Trust Fund is projected to be depleted by 2033. At that point, the program would rely solely on ongoing payroll taxes to pay benefits, which are expected to cover about 77% of scheduled payments.

If no changes are made, benefits would be automatically reduced by roughly 23% starting in 2033.

What Would Benefit Reduction Mean?

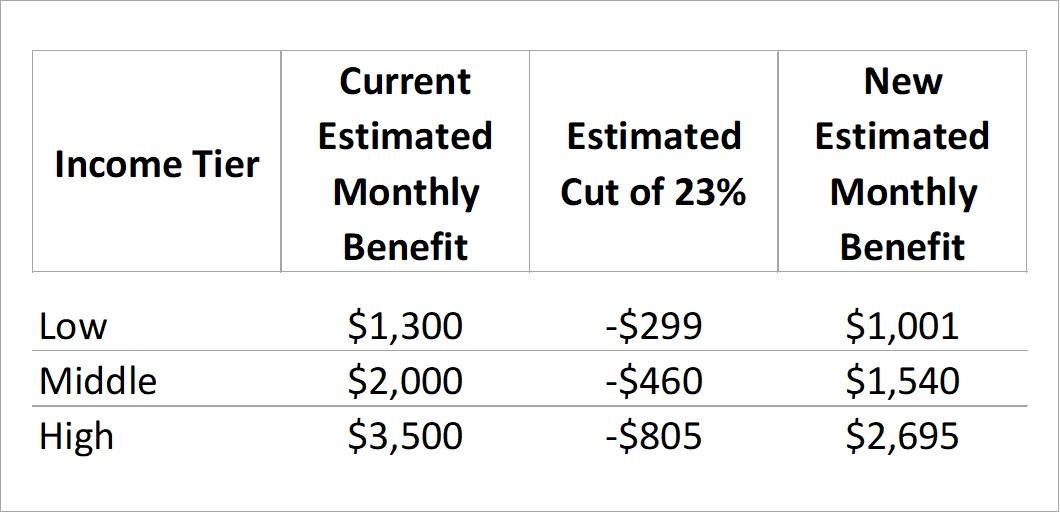

If reductions occur across the board, here’s what the estimated impact could look like by income tier:

Source: Moore Financial Advisors

Will Cuts Affect Current Retirees?

This is one of the most frequent questions we’re asked. So far, Congress has never reduced benefits for current retirees

Most proposals focus on future beneficiaries or apply gradual changes, such as adjusting the retirement age or benefit formulas for younger workers.

However, if lawmakers do nothing, all beneficiaries—current and future—would face automatic cuts in 2033 due to the trust fund running dry.

What Is Being Proposed to Fix This?

There are several ideas on the table, but no consensus yet. Here are a few commonly discussed options:

- Raising the Full Retirement Age (FRA) Budget proposals supported by the Republican Study Committee and Project 2025 have called for increasing FRA from 67 to 69; some versions of these proposals would roll out before 2033. This effectively cuts benefits for many, especially low- and middle-income workers, even if reductions aren’t framed as “cuts.”

- Lifting the Payroll Tax Cap Currently, wages above $176,100 (2025) are not taxed for Social Security. One proposal would apply payroll taxes on income up to $250,000.

- Targeted Cuts for Higher Earners Some reform plans propose benefit reductions for higher earners while preserving or increasing them for lower earners. These reductions would go into effect around 2029 for new beneficiaries with higher incomes, phasing reductions up to 50% for individuals earning over $180,000 in modified adjusted gross income (MAGI) or joint earners over $360,000.

- Increasing Payroll Taxes Slightly Raising the 6.2% payroll tax to 6.4% or higher to bring in more revenue.

- Means Testing Some proposals suggest reducing benefits or slowing the cost of living adjustment (COLA) for retirees with high net worth or income from other sources.

- Backdoor Privatization Plans Recently Treasury Secretary Scott Bessent said that “Trump baby accounts” or child savings accounts are a back door for privatizing Social Security, although he later back-peddled on that statement. This raised concerns about eventually shifting FICA payroll tax funding into private investment vehicles—undermining Social Security’s defined-benefit structure and reducing program coverage over time—even if not explicitly cutting current benefits.

- Alternative Funding Models Republican Senator Bill Cassidy and Democratic Senator Tim Kaine have proposed an alternative funding model for the safety net program, which would supplement the program’s Trust Fund with a new diversified pool of investments. Their proposal would create a new, parallel investment fund for Social Security. They estimate that the fund would require an up-front federal investment of $1.5 trillion, and propose that it be given 75 years to grow. The Treasury would shoulder the burden of supporting current benefit levels through borrowing during those 75 years. At the end of 75 years, the fund would pay the Treasury back and supplement payroll taxes to help fill the future gap.

Important: No plan has been signed into law yet—but there is broad bipartisan agreement that something must be done before 2033.

If I’m Eligible, Should I Start Benefits Now?

If you’ve reached Full Retirement Age (FRA, currently 67) and are waiting until age 70 to claim your maximum benefit, you may be wondering if you should claim now to avoid possible benefit reductions in the future.

Here’s our advice:

- There’s no clear reason to change course—yet.

- For now, the rules remain unchanged. By waiting until age 70, you still earn delayed retirement credits, increasing your benefit by up to 8% per year between FRA and 70.

- Current beneficiaries are the least likely to face reductions.

- Starting benefits now doesn’t necessarily “lock in” protection against cuts—but neither does waiting expose you to significantly more risk. Historically, any benefit reductions or reforms have applied to future retirees, not those already collecting. Some proposals (see below) include making changes before 2033, but none to date include cuts for current beneficiaries before 2029.

- Cuts (if they happen) would likely be phased in or income-based.

- Congress has options. For example, they could preserve full benefits for those already collecting, or protect lower earners while modifying formulas for higher-income individuals.

- We recommend continuing to base your claiming decision on longevity, tax, and income needs, not on speculation. If your plan supports delaying until 70, it likely still makes sense to do so—unless there’s a sudden policy change (which we will monitor closely).

What Does This Mean for Your Financial Plan?

While the uncertainty surrounding Social Security is real, it’s important to remember:

- Cuts are not guaranteed, and changes are likely to be phased in

- If you’re already collecting—or soon will be—you are less likely to see reductions

- For younger clients, we plan with a margin of safety—factoring in modest benefit reductions as part of our retirement projections

As always, we are monitoring developments and will adjust your plan if needed.

If you have questions about how Social Security fits into your personal plan—or if you’re nearing retirement and want to discuss timing your benefits—please reach out.

-SM