Charitable giving is a meaningful way to support causes you care about, and many charitably minded people decide to give for reasons above and beyond personal financial considerations.

However, it is worth knowing how donations can help reduce your tax bill.

With the One Big Beautiful Bill Act (OBBBA) signed in 2025, the rules for charitable deductions are changing significantly in 2026.

Understanding these changes, and planning ahead, can help you maximize both your generosity and your tax benefits.

The following article:

- discusses key changes in the tax law related to charitable giving

- lists some tax-smart strategies to keep in mind

- explains how Medicare costs can be impacted by Qualified Charitable Distributions (QCDs)

- provides “optimization scenarios” designed to show how charitable giving can reduce your tax liability

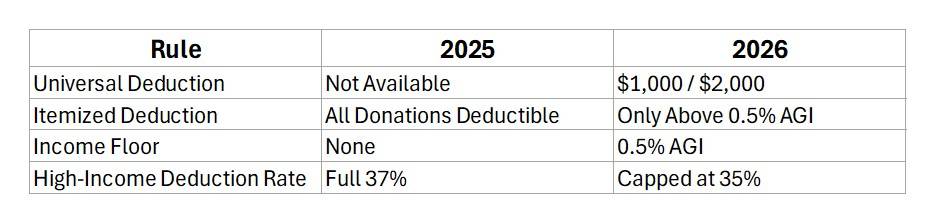

Key Changes in the Tax Law – Summary

Detailed Explanation of Key Tax Law Changes

Universal Deduction

Starting in 2026, taxpayers who do not itemize can still claim a deduction for charitable giving.

This universal deduction allows $1,000 for single filers and $2,000 for married couples filing jointly. It applies only to cash donations to qualified operating charities (not donor-advised funds or private foundations).

This deduction is not subject to the new 0.5% AGI floor for itemized deductions of charitable contributions.

This change broadens access to tax benefits for middle-income households who typically take the standard deduction.

Itemized Deduction

In 2025, itemizers can deduct all qualified charitable contributions without restriction.

In 2026, itemized deductions for charitable giving are allowed only for amounts that exceed 0.5% of Adjusted Gross Income (AGI).

This may discourage smaller donations from itemizers who do not exceed the income floor.

Income Floor

The 0.5% AGI floor introduced in 2026 means that only charitable contributions above this threshold are deductible for itemizers.

For example, a taxpayer with $200,000 AGI must donate more than $1,000 before any of the donation becomes deductible.

This rule is intended to limit deductions to more substantial charitable contributions.

Taxpayers may choose to make larger charitable contributions in 2025 to avoid the floor when it goes into effect in 2026.

High-Income Deduction Rate

In 2025, high-income donors in the top tax bracket (37%) receive the full benefit of their charitable deductions.

In 2026, the value of these deductions is capped at 35%, even if the donor is in a higher bracket.

This reduces the tax incentive for large donations from wealthy individuals and may affect overall giving levels.

Tax-Smart Strategies for Charitable Giving

Universal Deduction

Starting in 2026, non-itemizers can deduct up to $1,000 (single) or $2,000 (married) for cash donations to qualified operating charities.

Bunching Donations

Combine multiple years of giving into one tax year to exceed the standard deduction and itemize.

Example: Instead of $5,000 annually for three years and claiming the standard deduction each year, accelerate giving plans: donate $15,000 in year one; itemize in year one to reduce tax liability; claim standard deduction in years two and three.

Giving Appreciated Assets

Individuals and couples with large brokerage (non-retirement) accounts can donate stocks, bonds, mutual funds, and exchange-traded funds that have increased in value directly to charitable organizations.

This approach avoids capital gains tax and allows donors to deduct the full fair market value of the donated securities, up to 30% of their AGI if the asset was held longer than one year.

If the asset was held less than one year, the deduction is limited to the cost basis of the asset.

Qualified Charitable Distributions (QCDs)

Individuals who are age 70½ or older can make donations directly from their IRAs. This approach is called a Qualified Charitable Distribution.

For those age 73 and older, the QCD counts toward the annual Required Minimum Distribution (RMD).

Also, the QCD is excluded from taxable income, so there is no need to itemize when utilizing this giving approach.

This strategy also helps lower the balance of the IRA, which could reduce RMDs (and taxable income) in future years.

QCDs are limited to $100,000 per person annually, and QCDs are not subject to the 0.5% “income floor” for those who itemize.

Why IRMAA Matters When Planning QCDs

If you’re on Medicare—or approaching eligibility—giving through Qualified Charitable Distributions (QCDs) can do more than reduce your tax bill.

It can also help you manage Medicare (Income-Related Monthly Adjustment Amount (IRMAA) surcharges.

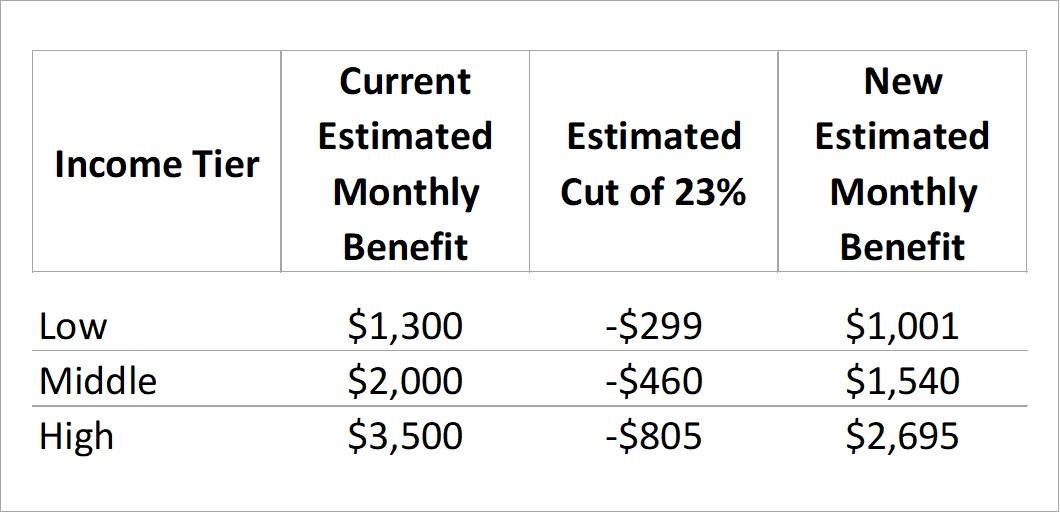

IRMAA is an extra premium added to Medicare Part B and Part D for higher-income beneficiaries. It’s based on Modified Adjusted Gross Income (MAGI) from your tax return two years prior.

Crossing into a higher IRMAA bracket can increase your monthly premiums by hundreds of dollars per person.

QCDs from your IRA can lower your MAGI, and lower Modified Adjusted Gross Income may keep you below an IRMAA threshold, reducing or avoiding surcharges.

Note that giving away appreciated assets from an Individual or Joint brokerage account won’t have the same effect on IRMAA as donating from your IRA, because itemized deductions from charitable contributions are subtracted after AGI (and MAGI) is calculated.

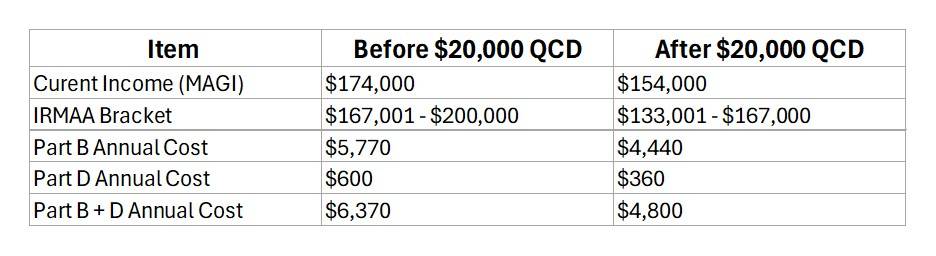

Example: How Charitable Giving Can Lower IRMAA Costs

The example below presents typical Medicare costs for an individual with current income of $174,000, and with reduced income of $154,000 after completing a QCD from their retirement account.

In this example, the individual saved $1,570 because the $20,000 QCD is excluded from taxable income, reducing federal tax liability.

Optimization Scenarios

Below we present four scenarios designed to show how charitable giving can reduce tax liabilities and possibly lower Medicare premiums at different levels of income for individuals and couples.

Couple, Ages 45, Income $200,000

A charitably minded couple typically takes the standard deduction.

Strategy: Use bunching—donate $30,000 every three years instead of $10,000 annually.

Benefit: In the bunching year, they itemize and deduct the full $30,000, saving roughly $7,400 in taxes.

Individual, Age 55, Income $400,000

A high-income donor faces the deduction cap in 2026.

Strategy: Accelerate large gifts in 2025 to get full 37% deduction and donate appreciated stock.

Benefit: A $50,000 gift in 2025 saves $18,500 in taxes vs. $17,500 in 2026 while avoiding capital gains tax.

Couple, Ages 65, Income $250,000

A couple near retirement with a large balance in a Joint brokerage account wants to increase their charitable giving.

Strategy: Combine bunching with appreciated asset donations.

Benefit: Donate $40,000 in one year using appreciated securities, deduct full value, and avoid capital gains tax—potentially saving $10,000+ in taxes.

Individual, Age 73, Income $300,000

A charitably inclined individual will face a higher tax bill because Required Minimum Distributions will increase their taxable income.

Strategy: Use Qualified Charitable Distributions to donate $20,000 directly from IRA.

Benefit: Satisfies RMD, excludes $20,000 from taxable income, reduces AGI and possibly lowers Medicare premiums.

-SM