Wednesday, July 2 marks the halfway point for the calendar year of 2025 – 182 days behind us, with 1 Wednesday, July 2 marks the halfway point for the calendar year of 2025 – 182 days behind us, with 182 days remaining.

And summer has kicked off in the northeast with an intense heat wave. After a cool late winter and early spring, stocks, too, are sizzling once again.

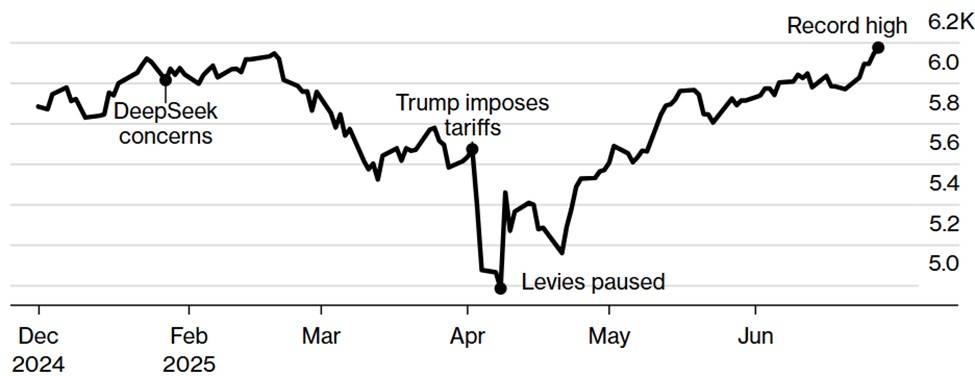

The chart below shows the path thus far in 2025 of the S&P 500 Index of large company US stocks.

Source: Wall Street Journal

The release of the made-in-China, low-cost artificial intelligence (AI) model DeepSeek caused US technology stocks to wobble in late winter.

Then, the imposition of draconian tariffs by President Trump in early spring precipitated a stock market plunge of nearly 20% from the recent peak in February.

But a pause in the most severe tariffs allowed for a stock market rebound. As of Monday, June 30, stocks reached a new all-time high.

Top of mind for many investors: can the stock market good times continue to roll?

In the absence of further trade / tariff setbacks, the answer is: probably yes.

The near-term path now seems to favor stocks moving higher amid ongoing economic growth; greater certainty on taxes; contained inflation; the anticipation of falling interest rates by the fall; and a consumer that continues to spend.

For the intermediate term, the precise price path that any asset will follow is impossible to discern. The chart above could be Exhibit 1 supporting this statement.

But for long-term investors who map out a plan and stick to it, the odds of realizing a satisfactory return are quite good.

For example, JP Morgan Investment Management’s Guide to the Markets shows that, for a balanced portfolio of stocks and bonds (60% stocks / 40% bonds, rebalanced annually) returns for each and every 10-year period since 1950 have been positive.

For the month of June, US stocks were up 5.1%, foreign stocks rose by 2.4%, and US bonds returned 1.4%.

Year-to-date, foreign stocks were the biggest winner, up by 20%. A weaker US dollar has contributed to the stellar returns for US investors in foreign stocks. Also year-to-date, US stocks have climbed by 6% and bonds have returned 4%.

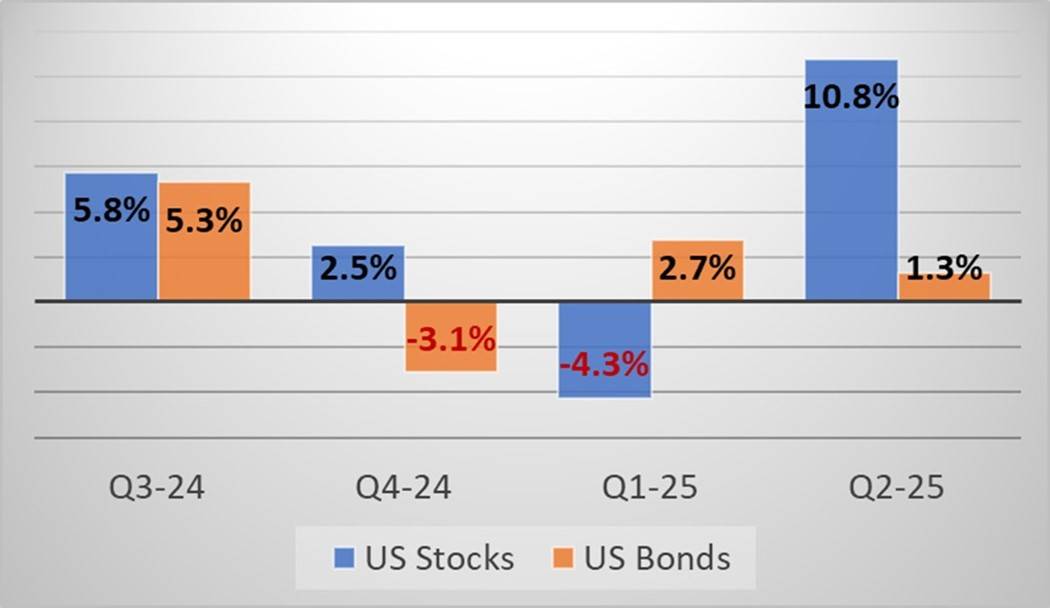

For a slightly longer historical perspective, the chart below shows returns by quarter for the past 12-month period for US stocks and bonds.

Source: Moore Financial Advisors & Morningstar

-RK