In Wayne’s World, the early 1990s cult-classic movie, protagonist Wayne and his sidekick Garth play street hockey on the neighborhood thruway. Automobiles pass frequently. Wayne and Garth don’t mind.

Street hockey provides an interesting model for thinking about financial markets. The cadence of shoot-score / shoot-miss / pause / move net off the street-move net back onto the street / restart is all part of the contest.

At times there are scores (when the market goes up). Other times, there are misses (when the market goes down). And, once in a while, external factors alter the field (for example, new and confusing government policy changes).

But the game continues under all conditions and players have an easier time if they take the changes in stride and continue to move forward.

Drawing the analogy to today’s situation, we’ve just passed through a miss / pause / net off the street phase. The net is now back in the road and the play has restarted.

And what of all the concerns about tariffs?

Some of us remain gravely concerned about tariffs, and also about unconventional (and even radical) policy approaches.

But many investors seem to think that Trump learned a lesson back in April, when the rout in stocks, bonds, and the US dollar forced a suspension of much of the global tariff rollout.

The financial market consensus reached in early May was that the final tariff plan is likely to be far more modest than the initial plan revealed on “Liberation Day” in early April, which has cleared the way for a sizable stock market rally.

Also, earnings reported by large US companies for the first quarter of 2025 were generally better than feared, and recently released economic data has exceeded expectations.

Gloom was pervasive in April, but lifted a bit in May as results haven’t been so bad.

A corollary to earnings is the confidence evidenced by company managers through their willingness to continue to spend money on current projects, and plan for new projects that will support and grow their businesses.

According to information compiled by Bloomberg, most of the largest publicly-traded companies (71%) that provided guidance after Trump’s early April bombshell have decided to maintain their capital expenditure outlook.

About 8.5% of firms have increased their spending plans, while 18% have revised them lower; 3% have withdrawn guidance. These results show that business confidence largely remains intact.

Some moderation (or at least temporary reprieve) in the tariff regime, as well as business profitability holding up and business spending plans remaining mostly intact, paved the way for “Game On” in the financial markets.

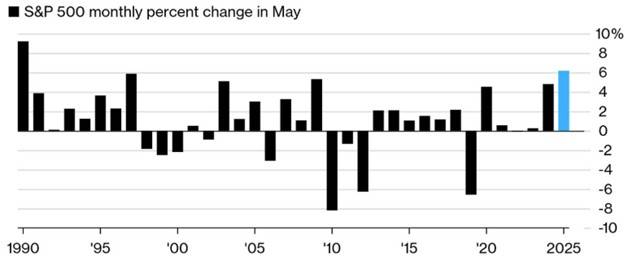

The old saying “sell in May and go away” was a dud in 2025, because last month was the best performing May in a quarter century.

The chart below shows monthly stock market performance for each May going back to 1990.

Source: Bloomberg

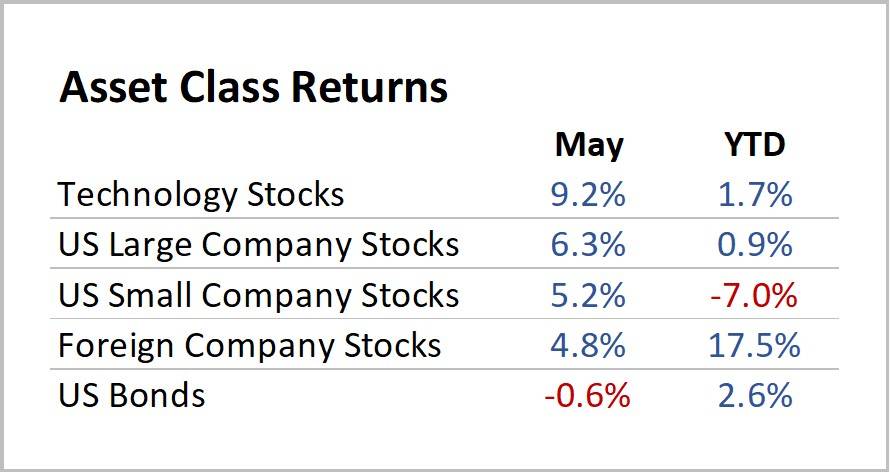

A second old saying, “markets climb a wall of worry” is holding true for 2025. Uncertainty has been outsized, but nonetheless, most asset classes at home and abroad have now registered positive returns.

Here’s how the performance of various asset classes stacked for the month of May and thus far in 2025:

Source: Moore Financial Advisors & Morningstar

-RK