Global Pandemic, Supply-Chain Breakdown, War in Europe, Inflation Flare Up, Crypto Crash, Bank Collapses, and US Debt Ceiling Debacle. A lot has been thrown at the financial markets, and at investors, during the past three years.

Stock and bond markets buckled in 2022, but eventually stabilized. So far this year, the tone and direction of the financial markets has generally been constructive. And investors have remained resilient.

As we look toward the back half of 2023, a main concern is: will the economy fall into a recession?

Some prognosticators are convinced that recession is the next shoe to drop, and that an economic downturn will lay the financial markets low once again.

David Rosenberg, a prominent Wall Street economist who currently runs his own research shop, is one of the economic bears.

In Rosenberg’s assessment, the odds of a deep recession starting in 2023 are 99%, and the stock market is likely to decline by 30%.

Morgan Stanley’s chief US equity strategist, Mike Wilson, is another naysayer.

In Wilson’s view, lots of economic uncertainty and over-optimism regarding corporate profit growth (meaning companies’ results are likely to disappoint in the quarters ahead) are cause for pessimism. He sees stock price declines ahead.

Billionaire hedge fund founder Cliff Asness, of AQR Capital Management, sees the possibility of a recession that “wouldn’t be mild” and concludes that stocks “are a scary place” to be.

These are smart and successful people (at least by Wall Street standards), so should we heed their warnings and steer clear of stocks? Or at least own fewer of them, if we believe a recession is nigh?

Implied in that question is the assumption that stock prices fall when a recession hits. So, is this true?

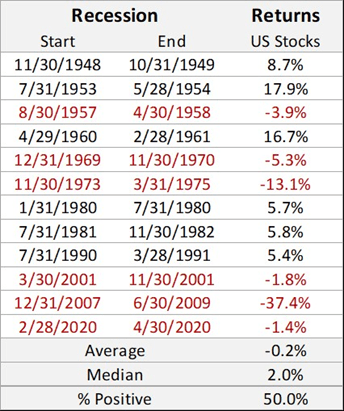

The answer is: sometimes, but not always. More accurately, the answer is: recessions have coincided with stock price declines half the time.

Researchers at Renaissance Investment Management have dug deep into the data and have concluded: timing your stock market exposure around a recession is harder than you might think.

The table below, from Renaissance, shows the twelve recessions that occurred in the post-World War II era along with US stock market performance during the recessions.