The unrelenting increase in Treasury bond yields and the stubborn inflation situation spooked the stock market in October. Hostilities in the Middle East and the fractious political environment in the US have also heightened investors’ concerns.

The negative financial market trends from August and September continued through most of October.

Stock returns fell again, further eroding a strong advance during the first half of 2023. The S&P 500 Index, which tracks the largest stocks in the US, slid into correction territory during the last week of the month (a decline of more than 10% from a recent peak) before ending the month on a more positive tone.

For October, the S&P 500 index of large company US stocks declined by 2.1%. Foreign stocks declined by 2.9%. Bonds took a beating last month, too: the Bloomberg US Aggregate Bond Index fell by 1.6%.

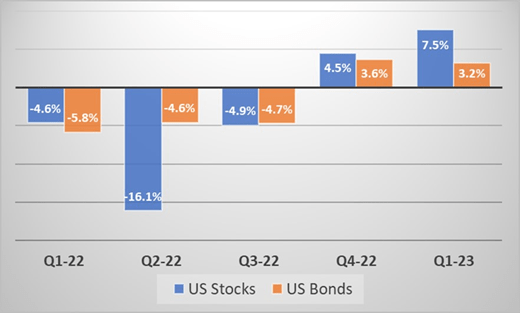

Below is a Summary of October Returns.

Year-to-date, stocks are holding onto gains. As of October 31, US stocks gained 10.6% and foreign stocks were up 3.8%. Bond returns year-to-date remain in the red: through the end of October, the major US bond market index declined by 2.6%.

RK